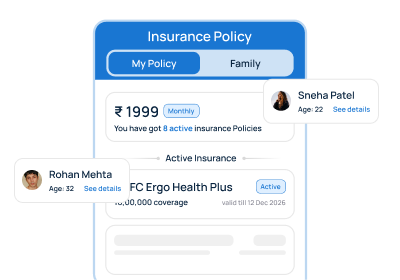

- It includes details like, Policy Name, Company, Policy Numbers, Policy Holder, Contact Number, Premium, Start and End Dates, etc.

- Useful for a complete view of your portfolio.

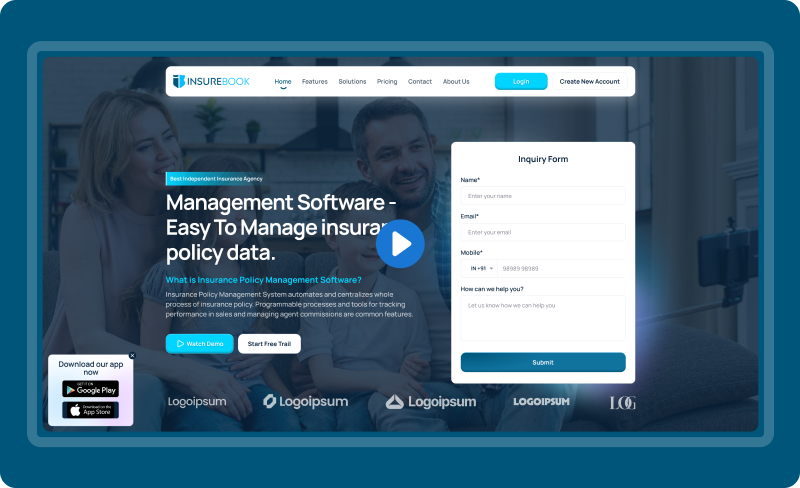

Insurance Policy Management System automates and centralizes whole process of insurance policy. Programmable processes and tools for tracking performance in sales and managing agent commissions are common features.

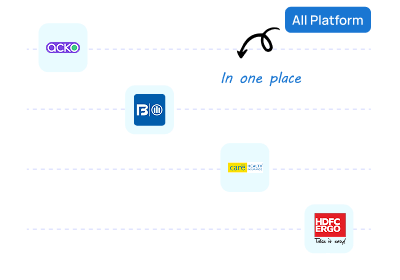

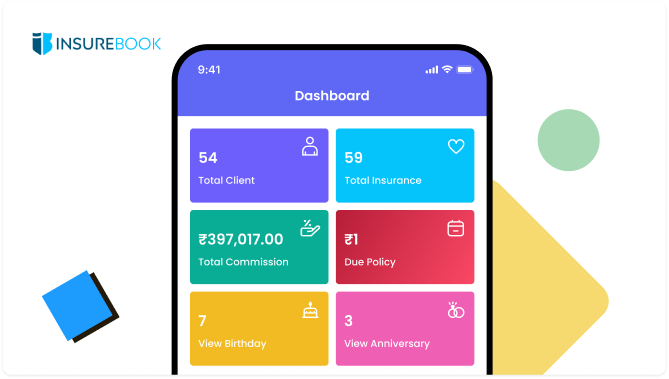

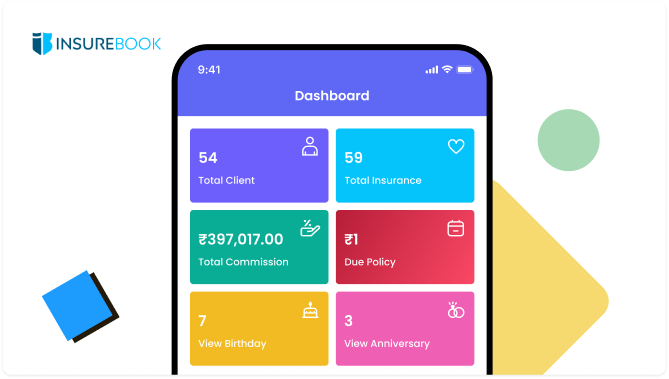

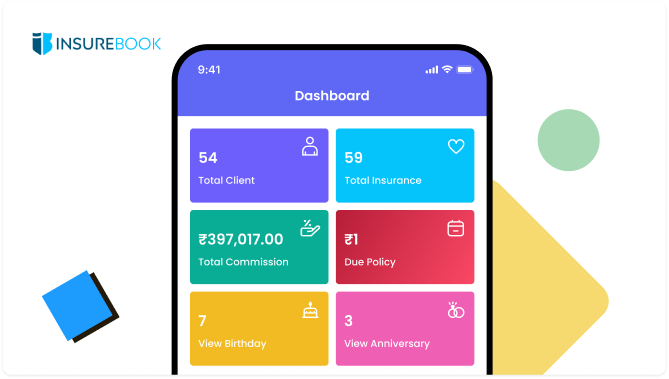

All-in-One Insurance Management Software for policy management, customer relationships and agency growth with our innovative solution. Streamline insurance management for agents, brokers & policyholders. Organize, track and manage your all insurance policies with InsureBook at one place.

Best Independent Insurance Agency Management Software has features like customizable dashboards, secure document storage, mobile access, streamlined workflows, improved customer satisfaction and boosted business growth. InsureBook offers extensive platforms for policy management, CRM, reporting and automation.

Manage your insurance policies and track coverage details

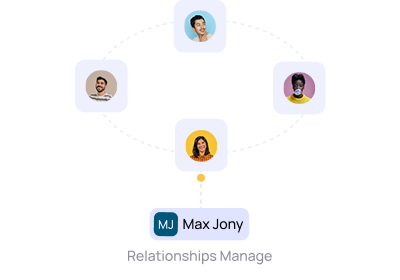

Streamline operations and manage client relationships

Comprehensive platform for insurance brokers

InsureBook is a comprehensive, effective insurance portfolio software covering all insurance management aspects. The insurance agency client management software helps agents and individuals manage their customers in the best possible way. It helps track every detail of a customer, such as policy type, contacts, and so on. Not only the insurance policy management software helps in managing clients, but also the simplest and synchronizes business operations.

Manage all types of policies like life, health, vehicle and others. Automated policy changes with alerts.

Agents have access to a central database for clients.

Monitoring policy status, expiration dates & renewal deadlines. Notify customers when policies are renewed or altered.

Insurance Policy Reminder Software offers personalized notification triggers and automated renewal reminders.

Commission payments and monitoring agent productivity.

Secure, scalable and reliable. One can access policy at anywhere at any time on your fingertips.

InsureBook is specifically designed for insurance agents, offering features like process automation, workflows, contact management and multi-channel communication to help build strong relationships with customers. Best Client Management Software for Insurance Agents to enhance customer relationships, streamline business operations and increase revenue. Streamlined operations & enhanced agent performance with InsureBook Best Insurance Management Software.

Best Client Management Software for Insurance Agents to enhance customer relationships, streamline business operations and increase revenue. Streamlined operations & enhanced agent performance with InsureBook Best Insurance Management Software. Insurance Brokerage Management System for brokers. Advanced Software for Insurance Brokers in India for all types of Agency.

Insurance CRM Software is designed to help an agents and insurance companies in enhancing their business processes and providing outstanding service to their clients.

InsureBook is a specialized solution which is designed to automate and streamlined the day-to-day activities for insurance agencies.

Insurance Management System Software can automate repetitive tasks, reduce paperwork and minimize errors. Quick policy updates and personalized communication via the Insurance Policy Administration System. Insurance Broker Management Software to manage and track every step of a policy.

Automate Repetitive Tasks Streamline operations with automated workflows

Top Insurance Management System Software can automate repetitive tasks, reduce paperwork and minimize errors. Quick policy updates and personalized communication via the Insurance Policy Administration System.

Insurance Broker Management Software to manage and track every step of a policy. Customized software for insurance agency management software to maintain all types of insurance policy and clients.

A web-based system called insurance policy management software helps customers, agents, and insurers in effectively managing policies, claims, commissions, and renewals.

Insurance companies, brokers, agencies, sub-agents, and even customers can use it to manage policy renewals and track policies.

Features like manage commission, role & permissions, data imports, SMS alerts, policy tracking, premium reminders, and dashboard customization are all included in the best solutions.

It minimizes manual paperwork, automates commission tracking, manages sub-agents, and enhances client service by providing immediate accessibility to policy specifications.

Yes, most top solutions like Insurebook provide customizable dashboards, role-based access, and flexible modules to suit business needs.

Yes, imports allow bulk upload of client and policy data using Excel/CSV formats with error-checking features.

Yes, SMS/email notification modules are available to send reminders for premium due dates, policy renewals, and updates.

Here are some key factors you should consider before choosing any CRM Software for Insurance Agent such as, Features & Functionality, Customizability, User-Friendly Interface, Data Security & Compliance, Cost-Effectiveness and, Integration Capabilities.